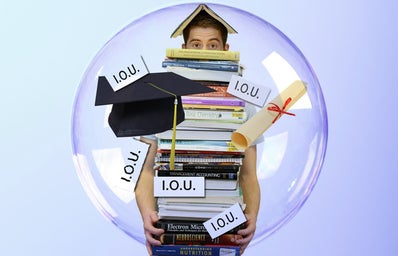

Student loan delinquency rates accelerated last year and hit new records, surpassing $166.3 billion in the third quarter and $166.4 billion in the fourth.

According to the Federal Reserve Bank of New York’s quarterly household-debt report, Bloomberg reported that the percentage delinquent at least 90 days, which is considered to be in “serious delinquency,” or in default has stayed at about 11 percent since mid-2012, but the total amount owed has increased to a record $1.46 trillion in December 2018, with unpaid student debt rising to the highest ever.

But student loan delinquencies have continued to climb even though unemployment has fallen below four percent, suggesting that wage stagnation may be the culprit, making it harder for individuals to manage their outstanding debt, NY Daily News reports.

Wages for college graduates “are not necessarily high enough for debt payments overall,” Ira Jersey, Bloomberg Intelligence interest-rate strategist, said. “If you have a choice to pay your student loan or for food or housing, which do you choose?”

Since most of the loans are government-sponsored, it probably won’t hurt the economy like other debt issues, Jersey said. “But incrementally, it does mean higher federal deficits if the loans are not repaid.”

The cost of college, however, has risen significantly, nearly doubling in the past 20 years.

The Federal Reserve Bank of St. Louis posted a blog post posing the question: “Is College Still Worth It?” The answer wasn’t a clear yes.

“In terms of wealth accumulation, college is not paying off for recent college graduates on average — at least, not yet,” the blog post read.

And according to this new study from LendEDU, new college graduates aren’t making what they expect to earn upon landing their first job after college graduation.

Some colleges and universities have taken note, however, of these increased costs of attending college, and have, in turn, not raised prices for necessities like room and board, and have offered to provide more financial aid.